Below is an excellent appraisal of the current new nuclear situation.

It becomes obvious that the likes of Eon RWE and EDF will not want an increase in the floor level of carbon as it may help nuclear but it will penalise their existing stock of coal and gas power plants.

They would prefer the government to help them with nuclear waste or potential accident liabilities.

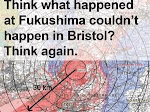

Accidents do happen and if, say, there is an accident in one plant somewhere it could well kill off the industry worldwide.

Why go to such dangerous levels to generate electricity?

Progress with energy effiiciency would have significant impacts before we even look at the alternatives.

If I was investing in shares at the moment---followwing the BP incident--I would keep miles away from an industry wihich carries such potential disasters!

Cameron Boosts Nuclear Incentives With Carbon Fee (Update2)

June 22, 2010, 11:06 AM EDT

More From Businessweek

By Catherine Airlie

June 22 (Bloomberg) -- U.K. Prime Minister David Cameron, in an effort to boost the use of nuclear power, plans to penalize polluters with a fee tied to carbon-dioxide emissions.

Cameron proposes a CO2 charge triggered when the price of European Union permits falls below a set level. That would raise costs for generating electricity from coal and natural gas, which are more-immediately economical than atomic reactors. The U.K. will propose tax shifts to “support the carbon price” later in 2010, the government said in a budget presented today.

“It’s a way of trying to subsidize nuclear, collecting that subsidy from all electricity consumers,” said Trevor Sikorski, director of carbon markets and environmental products research in London at Barclays Capital. Coal-burning utilities would be the hardest hit and “would pass the costs straight through to consumers,” he said.

U.K. utilities already pay for emission allowances under Europe’s cap-and-trade program, started in 2005 to discourage fossil fuels. Cameron, who took office last month, is reacting to the 47 percent decline in the price of permits during the past two years as the recession cut industrial production. That undermined incentives for cleaner energy at a time when Britain needs an 80 percent reduction in greenhouse gases by 2050.

Cameron intends to promote nuclear reactors, which emit almost no CO2 and cost as much as $5.8 billion to build, without direct subsidies. The nation’s newest atomic plant, Sizewell B, was approved in 1987 and began generating in 1995.

‘More Certainty’

“The Government will publish proposals to reform the climate change levy in order to provide more certainty and support to the carbon price,” according to the budget published on the Treasury’s web site. Changes in the current change levy, now assessed on all energy consumers regardless of their CO2 emissions, would be included in next year’s finance bill, the document said.

“There is a place for nuclear as long as there is no subsidy,” Energy Minister Charles Hendry said in a June 16 speech at the Nuclear Industry Forum conference in London. “The view is that we can have a carbon floor price, so then if the European Union trading scheme is below that, then a supplementary charge will bring it up to that floor.”

Electricite de France SA, with 15 reactors in the U.K., stands to benefit. The Paris-based company has lobbied for a carbon floor since it bought British Energy in 2009. EDF and partner Centrica Plc plan to build four 1,600-megawatt reactors at Sizewell and Hinkley Point in England over the next 15 years.

“A floor price for carbon was an important part of the future investment framework,” Vincent de Rivaz, chief executive officer for EDF’s U.K. operations, said in a May 12 statement.

Supporting Nuclear

Utilities need about 80 pounds ($118.50) a megawatt-hour to justify new reactors, compared with today’s price of 43 pounds for U.K. power, according to research by Royal Bank of Scotland Group Plc. “It’s not obvious that someone could build a merchant nuclear plant without some kind of support,” said Iain Turner, a utilities analyst at RBS in London.

While EU allowances for December are up 25 percent this year to 15.47 euros ($19) a ton as of 3:10 p.m. in London, they are below the 100 euros needed to encourage utilities to build energy facilities that don’t produce greenhouse gases, according to David King, chief U.K. scientist until 2007.

The same December carbon contract rose as high as 33.55 euros a ton in April 2006 and neared 30 euros again in the summer of 2008 before the recession sapped demand for power and pulled down permit prices.

The Conservatives haven’t said what the carbon floor should be. The level may be 35 pounds, the Sunday Times reported last month without saying where it got the information.

Clash Over CO2

RWE AG, Britain’s third-biggest generator, opposes the carbon floor. The company, which uses coal, gas and oil to fuel its British plants, and partner E.ON AG, Germany’s largest utility, own Horizon Nuclear Power. It plans to build 6,000- megawatts of nuclear capacity by 2025 at its Wylfa site in Wales and Oldbury, southwest England.

The U.K. policy on carbon costs “is not necessarily the best solution,” Volker Beckers, CEO of RWE Npower, said in a May 20 e-mailed statement. “There are a number of possibilities that need to be examined.” He didn’t specify the other options.

U.K. utilities and factories will lobby intensely over the carbon price, Tim Warham, London-based assistant director at Deloitte LLP, said in a May 14 interview. Calculating the level will be “fraught with difficulties,” he said.

‘Difficult Issue’

“It’s a difficult issue to get right,” Ian Marchant, CEO of Scottish & Southern Energy Plc, said on May 19 conference call on May 19. The Perth-based company, working with Bilbao, Spain-based Iberdrola SA, plans to build a new reactor in Cumbria, England and supports a higher CO2 price.

U.K. utilities need to spend 200 billion pounds over the next decade to replace plants and infrastructure, according to U.K. regulator Ofgem.

Teollisuuden Voima Oyj and Areva SA are building the world’s largest reactor in Finland. The plant has been delayed by four years until 2013, according to a TVO estimate this month, and Areva said costs are over the originally estimated 3 billion euros.

The risks in building reactors are “so big and significant that if they go wrong, even the biggest utilities could be financially damaged beyond repair,” Peter Atherton, a London- based analyst for Citigroup Inc., said in a May 13 report.

--With assistance from Kari Lundgren, Mathew Carr and Lars Paulsson in London, Kati Pohjanpalo in Helsinki. Editors: Mike Anderson, Steve Voss.

Wednesday 23 June 2010

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment